Co-founder of Bitcoin (BTC) security company Casa Jameson Lopp is less optimistic than the rest of the crypto community that a spot Ether (ETH) exchange-traded fund (ETF) will be approved by the US Securities and Exchange Commission (SEC) later this year.

Lopp tells Magazine, “I’m skeptical that we will see any other crypto ETFs get approved any time soon.”

The reason for Lopp’s audacious opinion is that Gary Gensler, the head of the SEC, has been largely reticent about Ether throughout the last five years.

Take a look at Gary Gensler’s quotes throughout the years. He has been asked several times if Ethereum is a security, and each time, he has declined to comment on the matter. They are attempting to compromise it in some way as a security measure.

If the spot Ether ETF is denied, he thinks it will simply encourage investors to pour more money into Bitcoin ETFs.

Since there won’t be any other options, he says, “I do expect that the Bitcoin ETF will probably be the only one, at least over the short to medium term,” which will cause a lot more money to flow into the Bitcoin ETFs.

Although Lopp’s knowledge of Bitcoin security has made him well-known, he feels that it limits his ability to talk about other subjects.

Despite his repeated attempts, he claims that expanding his content is akin to tossing petrol on the flames.

“Eventually, you make a comment regarding a different subject, and you receive criticism and may even be fired. I think this happens because you disrupt a certain segment of your audience’s mental paradigm,” he explains.

He so frequently encounters resistance when he tries to switch things up or talk about another cryptocurrency.

I experience this at least a few times a year. And typically, it’s because I’m going to be discussing some other protocol or cryptocurrency asset, after which there’s a specific portion of the public that has embraced a particular set of views,” he says.

Lopp’s disapproval of the SEC’s anti-crypto narrative is one that he often repeats: “I think you have to treat the SEC as an adversarial actor and expect that they’re going to do everything that they can to prevent any other ETFs from launching.”

What led to X’s fame?

Lopp asserts that he has consistently posted during the highs and lows of the cryptocurrency market.

However, he nearly feels as though his efforts to increase his following during the down markets were in vain.

“I think I could have reached my current position if I limited my tweeting to bull markets, as that’s also when the majority of my followers joined me,” he says.

He’s one of the lucky ones who got his last name, “Lopp,” as his X handle without having to add any awkward underscores or numerals.

However, he can’t think of a single viral article that significantly increased his following to 459,300 as of right now. For the past ten years, he has just been working hard:

Particularly during the 2017 Market, there wasn’t one tweet that helped me gain an enormous following. I remember that, for a few months during the market’s heyday, I was gaining more than a thousand followers per day.

What type of content do you do?

Lopp’s X account keeps you up to date on Bitcoin news and self-custody advice, much like a helpful encyclopedia on your feed.

He says, “I think it’s good to have a little entertainment value, so I will regularly tweet out educational content, whether it’s deep dives that I’ve done, or whether it’s just sort of fun facts that I come across or pop into a fair amount of dunking on crypto critics.”

He also has a funny sense of humor when it comes to his social media posts.

His most famous piece to date wasn’t about cryptocurrency; instead, it was instructive.

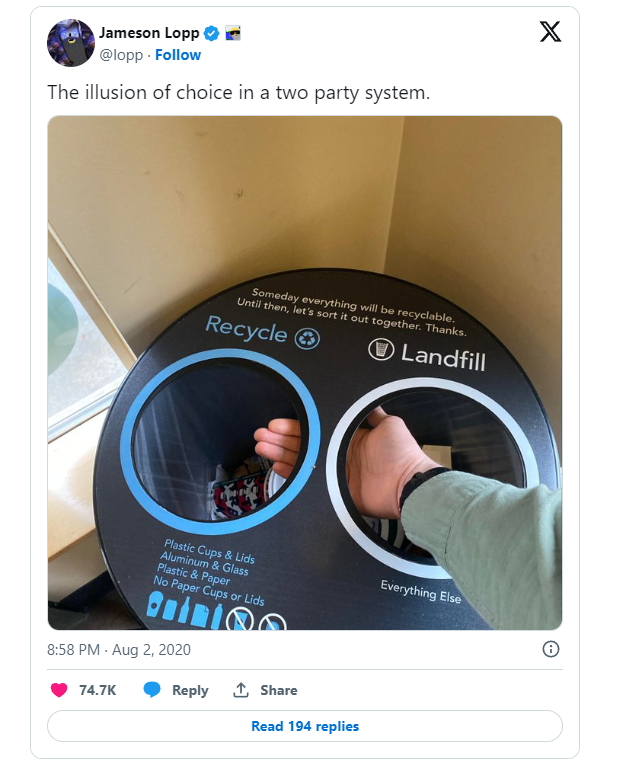

He first made public a misleading recycling and landfill bin in August 2020, which looked to be distinct but was simply one bin.

What type of content do you like?

Lopp is primarily interested in monitoring cryptocurrency developers and industry builders.

Different from others, he isn’t interested in searching for the subsequent colossal crypto gain of 100x.

In summary, I primarily follow builders. Since I wasn’t as invested in this as I should have been,” he says.

He is more interested in the core ideas of Bitcoin, such as regaining citizen power and opposing large investment banks.

“I started with the libertarian perspective on power dynamics. According to Lopp, “I think I will always be more interested in discussing the idea of disempowering institutions and authorities.”

Price Predictions?

Lopp could be better at predicting the future, especially when it comes to Bitcoin pricing, so don’t bother asking him to read your palms.

He laughs, “No, I never do because I’m always wrong.”

For Lopp, it hasn’t even worked to sugarcoat a price projection that might not come to pass. About five years ago, he remembers making a solid prediction that sparked criticism:

Wishful thinking, I started my tweet, but if the pattern holds, Bitcoin will reach $250,000 before the end of the year. Even that was misinterpreted, and I thought, “Do you people not understand that wishful thinking is not a price prediction.”

He’s so anti-price prediction that he notes whenever a well-known figure in the crypto sector makes a false prediction so he can laugh at them later.

To laugh at those predictions later, Lopp says, “I archive that prediction and then put a calendar reminder for a year or two or three in the future.”

Conclusion

In a landscape as dynamic and complex as the cryptocurrency market, diverse viewpoints are invaluable. Jameson Lopp’s perspective on Ether ETFs and BTC price predictions serves as a counterbalance to unbridled optimism, reminding us to weigh the risks against the rewards. By staying informed, doubling down on research, and fostering careful, intentional investment strategies, crypto enthusiasts can better position themselves to weather the market’s inevitable storms and seize its opportunities.