Gold Weekly Forecast: Gold faced difficulties in establishing a clear direction and concluded the week with a slight decline. As we approach the next week, investors are eagerly anticipating the release of US inflation statistics for January. They will also closely monitor technical advancements in the market, hoping for cues to guide their decisions regarding the Gold Weekly Forecast.

· Gold failed to make a decisive move in either direction.

· $2,020 aligns as the first near-term technical support for XAU/USD.

· January inflation data will be featured in the US economic docket next week.

Gold price fluctuated in a relatively narrow channel this week.

Federal Reserve (Fed) Chairman Powell reiterated that it was probably too soon to start reducing rates at the March policy meeting in a broadcast interview with CBS News’s 60 Minutes on Sunday. Additionally, he restated that people could go sooner if they convincingly witnessed inflation or a lousy labor market. Gold ended the day in negative territory near $2,020 as the benchmark 10-year US Treasury Note yield increased more than 3% on Monday, continuing the rise sparked by the strong jobs report.

The US Dollar Index corrected lower, along with US yields, in the absence of significant macroeconomic data releases and fundamental catalysts, allowing XAU/USD to launch a minor recovery.

A potential truce agreement with Israel was met with a “generally positive” response from Hamas, according to Qatar, which is serving as a mediator, late on Tuesday. Nevertheless, this headline did not ease worries of a worsening crisis in the Middle East since an Israeli official told Israel’s Channel 13 that several of Hamas’s demands in the counterproposal were utterly ridiculous.

Risk flows took center stage in Wednesday’s financial market activity as the S&P 500 Index reached a fresh all-time high following the opening bell. XAU/USD failed to build positive momentum even though the USD had trouble finding demand due to the improving risk attitude. Gold had to give up its earlier gains as the 10-year US T-bond yield rose beyond 4.1% later in the American session. This was because the highest yield at the most recent 10-year Treasury Note auction was 4.09%.

Following a revision of 227,000 the week before, the US Department of Labour said on Thursday that there were 218,000 first claims for unemployment benefits for the week ending February 3. Gold found it challenging to regain footing while the USD held firm versus its competitors. Thomas Barkin, the president of the Richmond Fed, told Bloomberg that they can wait to raise interest rates since robust inflation data must be maintained and expanded.

On Friday, the US Bureau of Labour Statistics (BLS) declared that it had changed the Consumer Price Index (CPI) increase for December from 0.3% to 0.2% every month. The Core CPI for the same period was 0.3% without revision. In the American session, Gold dipped somewhat as the US 10-year yield kept rising in the lead-up to the weekend.

Check out some more important article below:

- Navigating Gold Price Movements Based on Powell Speech

- China Markets Wobble Again

- Japanese Yen: A Familiar Range Ahead of FOMC

Gold price could react to US inflation data technical developments.

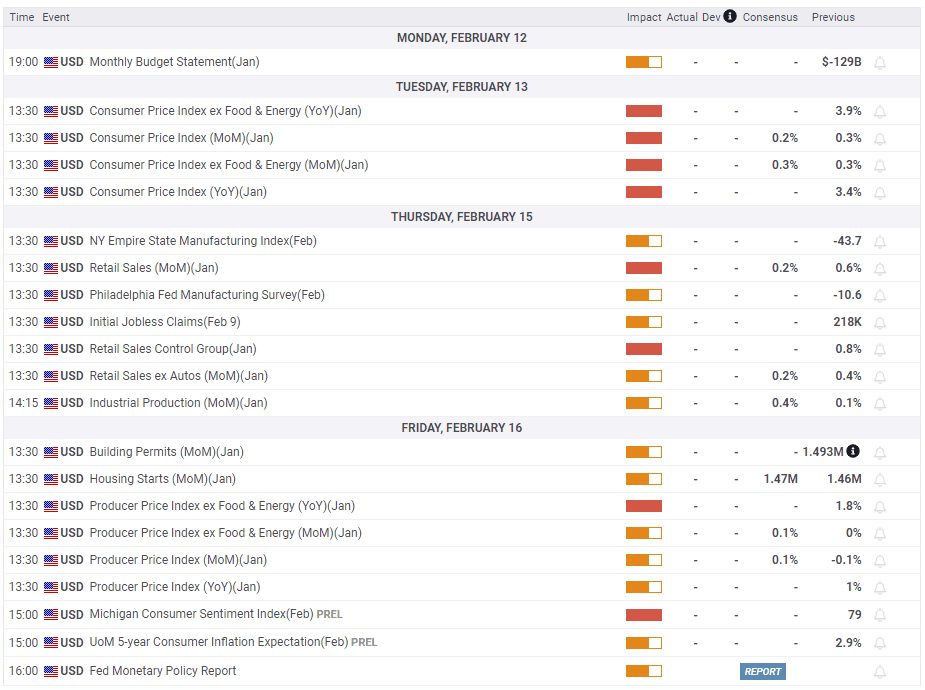

On Tuesday, the BLS will disclose data on inflation for January. The CPI and the core CPI, which do not include volatile food and energy costs, are expected to increase by 0.2% and 0.3% every month, respectively. Suppose monthly CPI readings are below zero percent or far lower than expected. In that case, market players will have to reevaluate the likelihood of a March rate decrease by the Federal Reserve. In this case, a decline in the US 10-year T-bond yield below 4% could support the bullish trend in XAU/USD.

The CME FedWatch Tool indicates an 82.5% chance that the US central bank will keep the policy rate at its current level at the upcoming policy meeting. If CPI prints exceed market expectations, there appears to be limited upside space for the USD based on market positioning. However, a strong inflation report could strengthen US yields and hinder Gold’s advancement.

The US economic docket for Thursday will include the January Retail Sales report. Since this data is not price-adjusted, it is unlikely to cause a significant market reaction.

Market investors will be watching the University of Michigan’s preliminary Consumer Sentiment Index data for February and the Producer Price Index (PPI) data for January before the weekend.

In conclusion, investors will only take significant positions based on the data released the following week if the US inflation report significantly changes the market price of the Fed rate forecast. Alternatively, they may closely monitor technical movements to identify short-term trading opportunities.

Gold technical outlook

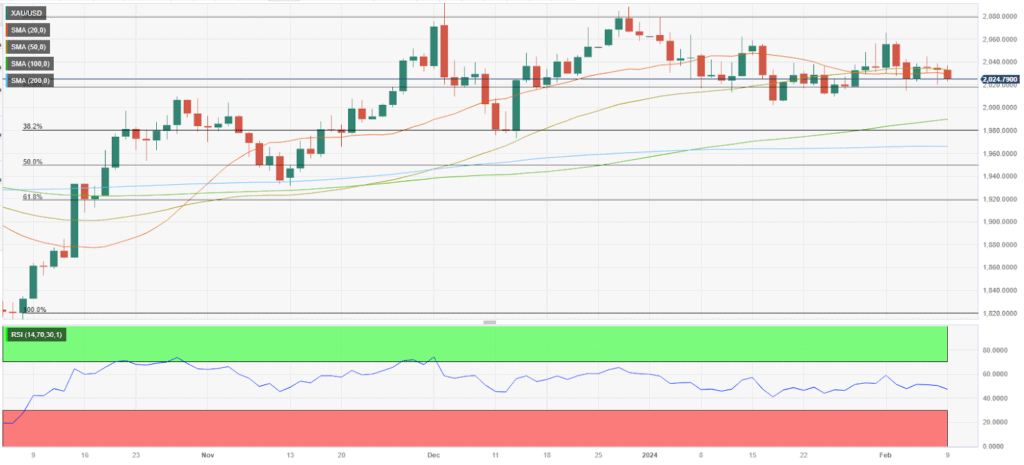

The daily chart’s Relative Strength Index (RSI) indicator moves laterally close to 50, indicating a lack of directional momentum. XAU/USD finds breaking above the 20-day Simple Moving Average (SMA) challenging.

To the downside, the psychological level of $2,000 (a static level) and the 100-day SMA of $1,990 (a 100-day SMA) align as the first support and the Fibonacci 23.6% retracement of the most recent rise, $2,020. However, the intermediate resistance is situated at the static level of $2,045, which is ahead of the static level of $2,060, and it lines up as the first resistance before the end-point of the uptrend, which is $2,080.

Conclusion

As investors navigate the uncertain waters ahead of the US inflation data release, gold prices remain locked in a tussle between key technical levels. Whether gold breaks through resistance or falls back down to test support, maintaining a well-informed strategy is indispensable.

For those vested in gold, staying abreast of market developments and shifting sentiments is a must. Opportunities and risks coexist in the nuanced dance of market forces, but a refined understanding of these dynamics could place you a step ahead. Stay vigilant, stay educated, and let the golden forecast guide your investment journey.

Remember to [subscribe to our newsletter], [follow us on social media], and [turn on post notifications] to get the latest updates on gold prices and financial news. Your informed decisions today form the bedrock of tomorrow’s investment success.