- Gold price loses ground as US Dollar improves on Tuesday.

- The improvement in US Treasury yields could impact the non-yield assets like Gold.

- Investors await FOMC minutes to gain the Fed’s perspective on the interest rate trajectory.

After breaking a three-day winning streak, the price of Gold moved marginally lower on Tuesday, scuttling to over $2,018 per troy ounce during Asian trading hours. The yellow metal’s prices face difficulties as a result of the strengthening US Dollar (USD), which is linked to rising US bond yields. Bond yields have been increasing, which has put downward pressure on non-yielding assets like Gold.

In addition, the market players are looking forward to the Federal Open Market Committee (FOMC) meeting minutes, which are expected to be released on Wednesday. This announcement may shed light on the Federal Reserve’s outlook for the future movement of interest rates.

But according to ANZ’s projection, the Federal Reserve (Fed) will begin reducing interest rates in July 2024. The CME FedWatch Tool indicates that there is a 53% chance that the US Fed will decrease interest rates by 25 basis points at its June meeting.

The US dollar was weaker on Monday as a result of recent dovish comments made by Fed officials, who suggested rate cuts in 2024. According to Mary C. Daly, president of the San Francisco Federal Reserve, three rate reductions would be a fair starting point for 2024. Furthermore, James Bullard, the president of the Federal Reserve (Fed) in St. Louis, recommended that the Fed take cutting interest rates into account during its meeting in March.

The four-day losing skid for the US Dollar Index (DXY), which compares the value of the US dollar against six other major currencies, is over. With the 2-year and 10-year yields on US bond coupons currently at 4.65% and 4.30%, respectively, the DXY is trading higher at 104.40.

Show More Article Below:

- The price of gold is erratic intraday due to conflicting fundamental signals.

- Gold Weekly Forecast Stuck between key technical levels ahead of US inflation data.

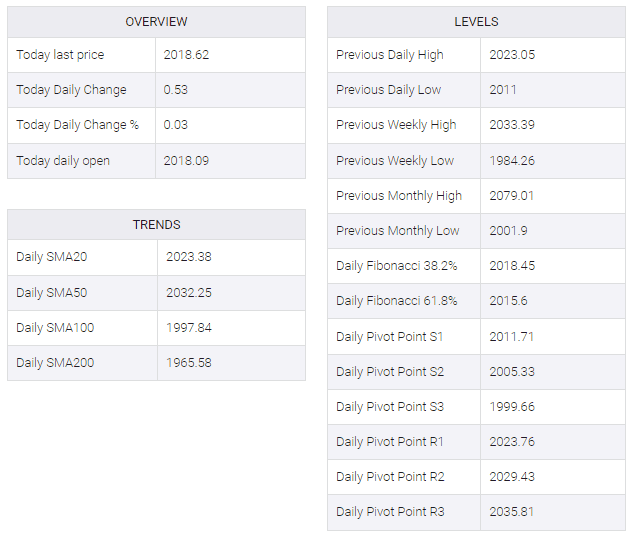

XAU/USD: TECHNICAL LEVELS TO WATCH

Conclusion

The retreat of XAU/USD to nearly $2,018 holds multifaceted implications for the landscape of gold trading and investment. By examining the historical performance of Gold, dissecting the factors that influence its price, and undertaking a meticulous forecast analysis, we have attempted to decode the market signals, preparing stakeholders for the road ahead.

Gold has always held an enigmatic allure, beckoning with the promise of prosperity and preservation of wealth. As we stand on the cusp of unknown market terrains, armed with insights gleaned from this forecast analysis, stakeholders have the opportunity to elevate their engagement with the precious metal market. Remember, in the symphony of the market, each note—be it high or low—presents an opportunity for those attuned to its melody.