The price of gold is consolidating its early Wednesday gain; there isn’t a new technical or fundamental catalyst for further increase. The US dollar’s weak liquidity due to the Juneteenth holiday is likely to keep the price of gold under the radar.

XAU/USD Technical Overview

This week’s range-play in the gold price is continuing, with sellers making a concerted effort to hold onto their positions.

The confluence zone around $2,340, where the 21-day and 50-day Simple Moving Averages (SMAs) are hanging out, caps the upside movement in the price of gold. Nonetheless, it seems that the $2,300 barrier is protecting the downside.

Gold sellers remain optimistic as the 14-day Relative Strength Index (RSI) remains bearish below the 50 mark, presently at 49.00.

The Bear Cross that is still in effect after the 21-day SMA crossed the 50-day SMA from above on a daily closing basis last Friday lends support to the bearish potential.

The $2,300 barrier is currently the area of immediate support; a decline below this level will test the $2,287 low from June 10.

If the latter is broken consistently, sellers will target the psychological barrier of $2,250 and could threaten the low of $2,277 on May 3.

Alternatively, any gold price recovery will need to be accepted above the critical confluence support that has since turned into resistance, which is located around $2,340.

On their journey to the June 7 high of $2,388; buyers of gold will next stretch their biceps towards the May 24 high of $2,364.

Fundamental Overview

Tuesday saw a significant recovery in the price of gold, which was fueled by a slight decrease in US Treasury bond yields and the release of US retail sales statistics. Disappointing data caused the US Federal Reserve (Fed) to resurrect its expectations for a September rate drop and destroyed the US Dollar along with US Treasury bond yields.

US retail sales increased by just 0.1% in May, according to data released on Tuesday. The previous month’s data was revised significantly lower to -0.2%, indicating that the second quarter’s economic growth was still sluggish.

According to the CME FedWatch tool, markets are now pricing in a 67% possibility of a rate cut by the Fed in September, up from a 61% chance one day earlier. This year, 48 basis points (bps) of reduction are priced in by the markets.

In the meanwhile, Fed policymakers maintained that prudence on inflation was warranted and recommended waiting for more evidence of cooling before starting a policy-easing trajectory.

Recent inflation data have been very encouraging, according to Chicago Fed President Austan Goolsbee, and Fed policymakers anticipate more easing shortly. According to St. Louis Fed President Alberto Musalem, the progress of inflation might take longer and happen more slowly than many market players now anticipate.

In the meanwhile, Dallas Fed President Lorie Logan stated that while the CPI data is “great to see,” “several more months” will be needed to have confidence that the rate will reach 2%. Logan also stated that the Fed is “in a good position, to be patient, on policy.”

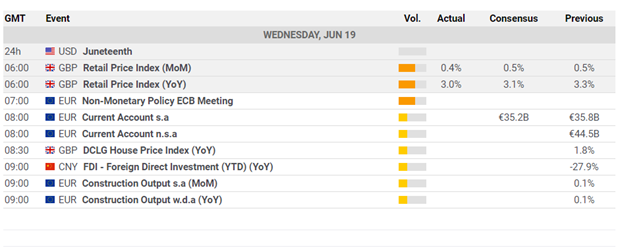

Looking ahead, in the absence of major macro events and Fedspeak because of a US market holiday, the price of gold will follow the mood of the wider market and the expectations around the Fed’s interest rate policy.