When selecting four Bitcoin ETFs for listing, the $30 billion advising business gave low costs, asset growth, and trading volume top priority.

Four of the ten Bitcoin BTC tickers down $51,605 exchange-traded funds (ETFs) have reportedly been added by financial services company Carlson Group to its offerings for registered investment advisers (RIAs).

Bloomberg reported on February 23 that the $30 billion investment firm chose funds from BlackRock, Fidelity, Bitwise, and Franklin Templeton based on factors like asset growth, trading volume, and low costs.

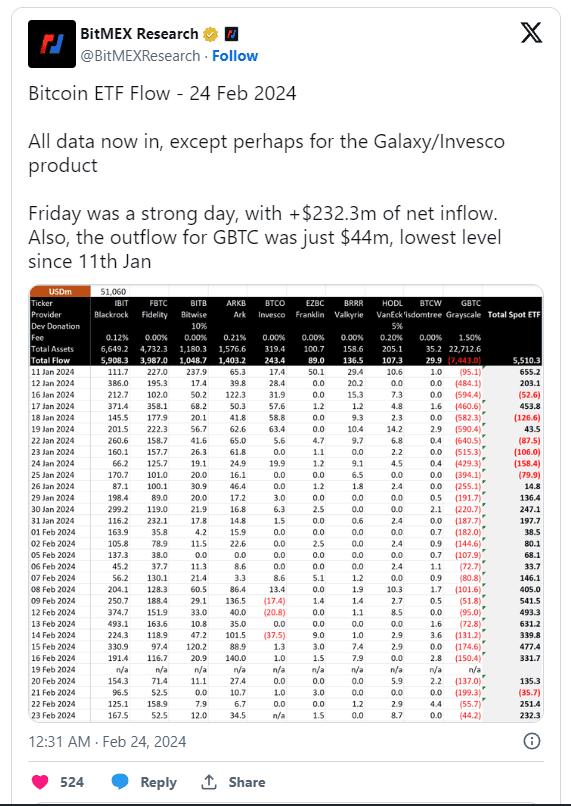

Since its launch on January 11, BlackRock’s iShares Bitcoin Trust (IBIT) has received investments totaling $6.6 billion, while Fidelity has witnessed inflows of $4.8 billion into its Wise Origin Bitcoin Fund (FBTC). The two issuers with the lowest costs are Bitwise Bitcoin ETF (BITB) and Franklin Bitcoin ETF (EZBC), which charge 0.2% and 0.19%, respectively.

In addition to seeing significant inflows and trading volumes, Bitwise and Franklin Templeton have committed to be the lowest-cost providers in the market. The company’s vice president and investment strategist, Bloomberg Grant Engelbart, stated, “Both firms have established in-house digital asset research teams and expertise that we feel are beneficial to the continuing growth and management of the products, as well as advisor research and education.”

Platforms for financial advisors are an essential first step in reaching new markets with cryptocurrency goods. Big trading companies like LPL Financial Holdings are looking into the newly authorized Bitcoin ETFs right now. If approved, more than 19,000 independent financial advisors managing assets valued at $1.4 trillion will have access to the funds. Charles Schwab and Fidelity financial advisers already have access to the ETFs.

The implementation of the Bitcoin fund may be delayed by due diligence from trading platforms, claims James Seyffart, an analyst with Bloomberg ETFs. Many large organizations, such as these warehouses and platforms where brokers and advisers operate, need help to purchase something. The analyst said, “There’s like an approved list and a not approved list.”

Conclusion:

Carlson Group’s commitment to embracing the digital currency era is a proactive move that sets the stage for a new chapter in the world of ETF investments. As we look ahead, Bitcoin ETFs could bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

The future of Bitcoin ETFs is one shrouded in both promise and unpredictability. Such uncertainty is not uncommon for groundbreaking financial instruments. But for now, the expansion of Carlson Group’s ETF lineup is a testament to the enduring innovation and adaptability of the financial industry.

Financial advisers, Bitcoin investors, and ETF enthusiasts stand to benefit from the launch of these Bitcoin ETFs. Their success and eventual widespread acceptance will depend on several factors, including market stability, regulatory support, and investor confidence. It’s an optimistic yet cautious step into a much-anticipated era where Bitcoin and traditional finance may find viable and lucrative synchrony. Whether you’re an adviser seeking new avenues for client portfolios or an investor curious about this digital gold rush, the advent of Bitcoin ETFs in the financial adviser toolkit is a buzz-worthy development you want to take advantage of.